Take Retailer-Supplier Collaboration to the

Next Level

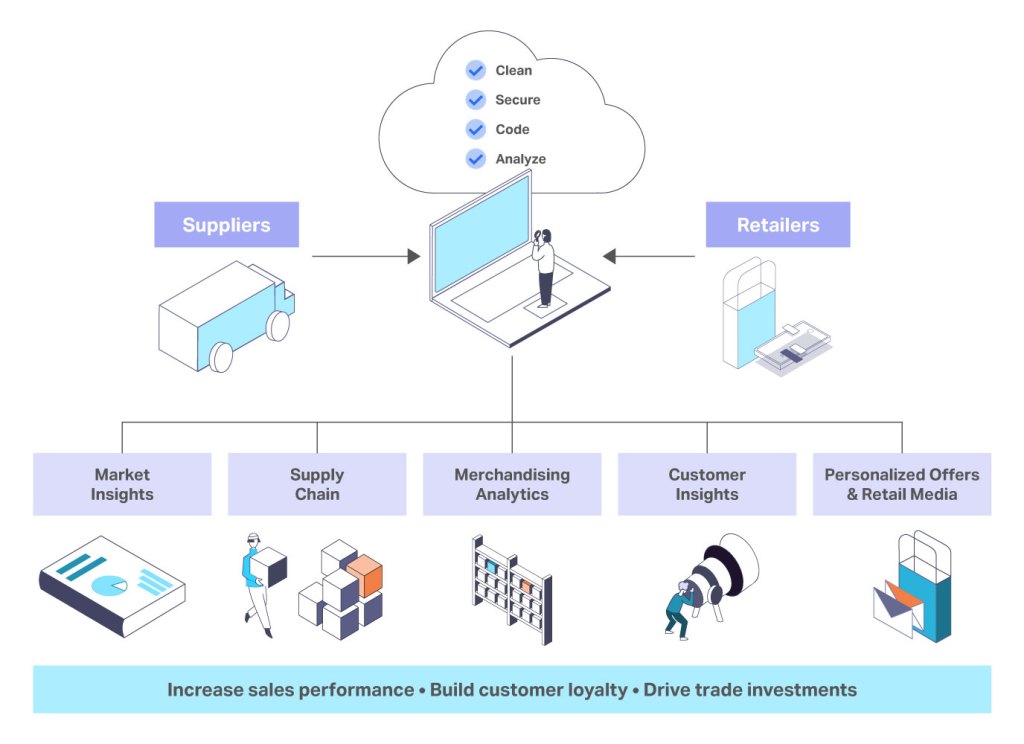

NIQ’s Connected Collaboration provides retailers and suppliers with one version of the truth, delivered via a robust suite with integrated data sources to ensure actionable insights. Our powerful solution arms you with intelligence to quickly make business-critical decisions in a fast-changing retail environment.

Brands call for more timely and precise retail media measurement: How should retailers respond?

The US retail media market is experiencing significant growth, but this surge in investment comes with challenges for brands around measuring campaign effectiveness.

12 March 2024

The Six Challenges Retailers Need to Master in 2024

In his session, “The Six Challenges Retailers Need to Master for Success in 2024” on January 16 at the NRF Big Show in New York, Jamie Clarke, Head of North America Retail, NielsenIQ, shared six challenges to master in 2024 that will impact the way retailers manage their operations.

01 February 2024

Brands step up retail media and personalization in the face of evolving challenges

The rapid evolution of retail media has motivated brand marketers to adopt business activities that did not exist even a few years ago.

20 December 2023

Enter a new era of collaboration

Over the past year, the retail industry has confronted market volatility, inflation, supply chain constraints, labor pressures, diminished consumer spending and an impending recession. To navigate these headwinds, retailers need solutions to focus on the customer experience, create efficiencies across the organization and drive future profitability.

Evolving consumer preferences require retailers to maintain a laser focus. Robust analytics, tools, real-time data, insights and close collaboration with suppliers are the keys to build loyalty and win at the shelf.

Want to outpace your competition and meet your goals? Connected Collaboration enables retailers and suppliers to work together across:

- NIQ Market Insights

- Customer Insights

- Supply Chain

- Merchandising Analytics

- Personalized Offers and Retail Media

By integrating retailer T-log and customer data with NIQ’s best-in-class core market measurement data – powered by advanced analytics, machine learning and AI – our comprehensive solution suite enables retailers and suppliers to quickly move from data, to insights, to activation.

All within a secure data sharing environment to help you:

- Deliver a win-win-win for you, your suppliers, and customers

- Achieve efficient, effective joint business planning

- Grow your business through flexible revenue sharing models

1

Trusted partner

With100 years of delivering retail measurement, NielsenIQ ensures highest expertise and data integrity in delivering data intelligence and strategic advice to drive successful outcomes.

2

Advanced technology

Actionable, data-fueled analytics and insights powered by software that is underpinned by best-in-class models and latest technologies to propel performance across the enterprise.

3

Best-in-Class Collaboration

One connected suite integrates retailer’s transaction log and customer data with core measurement data and real time analytics, enabling retailers and suppliers to quickly make decisions.

Our comprehensive solutions, analytics and scalable platform unleash the power of data to help retail leaders better understand shoppers, merchandise, and markets to win at the shelf.